In virtually any organization, controlling revenue is critical for sustainable development and financial stability. The revenue period encompasses the entire process from the initial client connection to the final assortment of payment. It requires numerous stages and activities that eventually determine the financial wellness of the organization. In this information, we shall investigate the revenue period in more detail, discussing its key parts, problems, and strategies for optimizing economic performance.

Release to the Revenue Routine:

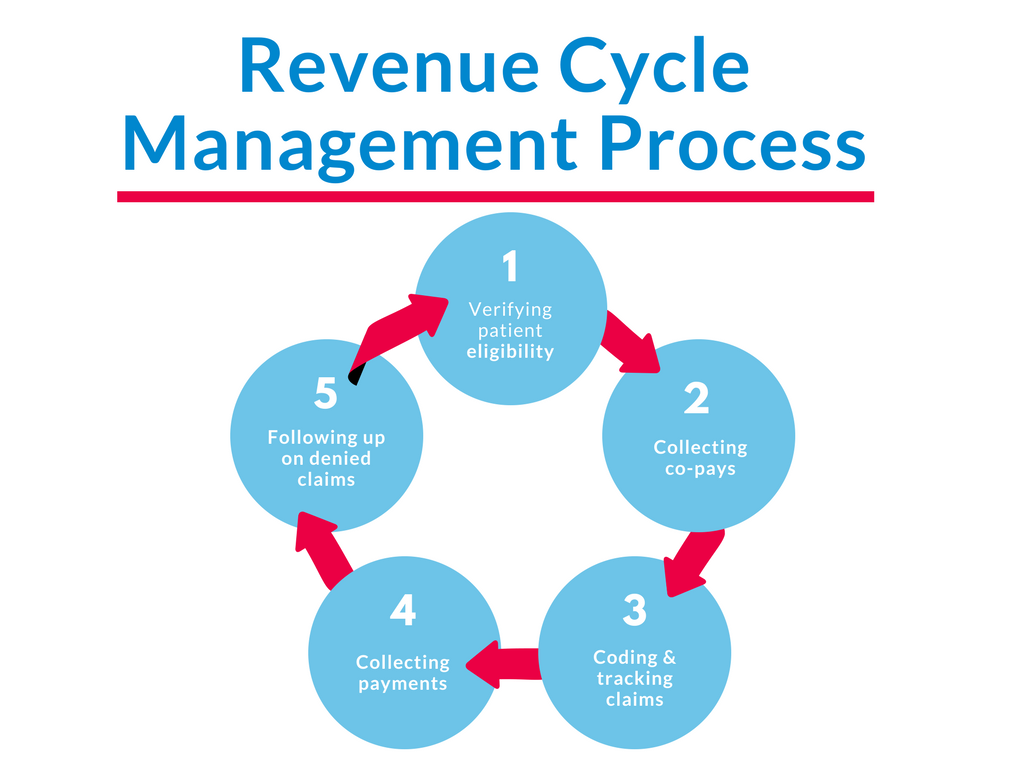

The revenue period shows the journey of revenue era inside an organization. It usually begins with lead era and marketing initiatives and advances through Revenue Cycle Management Company , get handling, invoicing, payment collection, and reconciliation. Each period in the revenue period plays a critical position in ensuring appropriate and appropriate revenue recognition.

Key Aspects of the Revenue Period:

a. Lead Generation and Marketing: Getting possible clients and producing understanding about products and services or services.

b. Revenue and Customer Order: Changing brings into clients through successful income strategies and negotiations.

c. Purchase Handling and Pleasure: Obtaining and control customer purchases, ensuring accurate solution distribution or service fulfillment.

d. Invoicing and Billing: Generating invoices for services and products or services rendered, including suitable pricing and terms.

e. Reports Receivable Administration: Tracking and remarkable obligations from customers, handling credit terms and cost terms.

f. Revenue Recognition and Confirming: Realizing revenue based on accounting maxims and regulations, ensuring accurate economic reporting.

Problems in the Revenue Cycle:

Controlling the revenue pattern effectively isn’t without their challenges. Some common issues contain:

a. Incorrect Data and Certification: Incomplete or inappropriate information may result in setbacks in invoicing and payment collection.

b. Billing and Code Mistakes: Mistakes in billing or coding may result in cost rejections or delays, impacting income flow.

c. Timely and Efficient Connection: Not enough apparent communication between sectors could cause setbacks or misunderstandings in the revenue cycle.

d. Complex Payment Systems: Working with diverse payment strategies, control costs, and reconciling transactions could be time-consuming and error-prone.

e. Conformity and Regulatory Demands: Adhering to industry-specific rules and accounting standards could be complicated and need ongoing monitoring.

Techniques for Optimizing the Revenue Routine:

To maximize financial success and ensure an easy revenue pattern, agencies can apply these strategies:

a. Improve Techniques: Identify bottlenecks and inefficiencies in the revenue period, and streamline processes to cut back delays and increase productivity.

b. Accept Technology: Apply strong revenue routine administration application and automation methods to enhance accuracy, speed, and efficiency.

c. Improve Data Reliability: Purchase data validation and quality get a grip on steps to minimize errors and errors in customer information and billing details.

d. Improve Connection and Venture: Foster efficient transmission and effort between divisions involved in the revenue pattern to minimize misconceptions and delays.

e. Check Critical Efficiency Indicators (KPIs): Establish and track appropriate KPIs such as for example days sales outstanding (DSO), collection charges, and revenue growth to measure and increase economic performance.

f. Staff Instruction and Education: Give ongoing education and education to personnel involved in the revenue pattern to make certain a deep comprehension of operations, submission, and best practices.

Realization:

The revenue period is a crucial aspect of financial management and organizational success. By understanding the important thing components, difficulties, and implementing efficient strategies, businesses can improve their revenue period, improve cash flow, improve customer satisfaction, and obtain long-term financial stability. Continuous checking, adaptation to market changes, and a responsibility to process improvement are crucial for organizations to thrive in today’s aggressive business landscape.